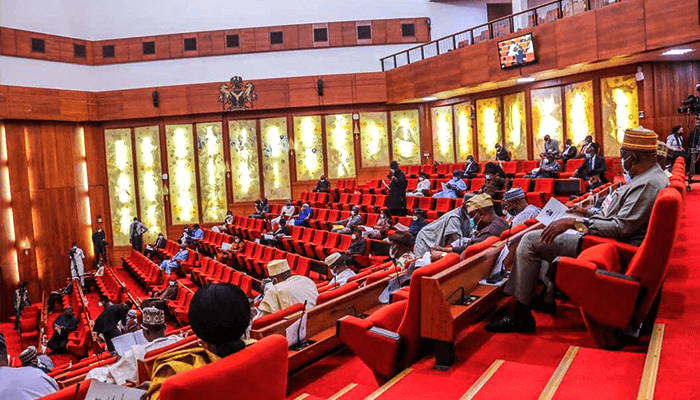

The Nigerian Senate confronts the President’s economic team over what lawmakers describe as poor implementation of the 2025 budget and unrealistic assumptions underpinning the proposed ₦58.7 trillion 2026 budget. The development unfolds during a tense budget defence session before the Senate Committee on Appropriations.

According to Mediaplusng.com, several senators raise concerns about widespread complaints of underfunding by Ministries, Departments and Agencies (MDAs), unpaid contractors, inadequate capital releases, and Nigeria’s rising debt profile. Lawmakers question whether the proposed 2026 budget framework reflects credible revenue projections and realistic economic assumptions.

During the session, members of the committee describe the defence presentation as one of the most unsatisfactory in recent years. They cite a controversial centralized payment system and delays in capital expenditure disbursement as major obstacles undermining effective budget implementation.

Mediaplusng.com reports that dissatisfaction with explanations offered by the Minister of Finance and Coordinating Minister of the Economy prompts the committee to seek clarification from the Chairman of the Federal Inland Revenue Service. The revenue chief acknowledges that past national budgets are often built on faulty assumptions, which subsequently create implementation challenges.

He tells lawmakers that unrealistic projections inevitably lead to shortfalls in execution, stressing that efficiency depends on aligning expenditure plans with achievable revenue targets. He urges the Senate to support a shift toward more credible and performance-driven budgeting anchored on realistic macroeconomic indicators.

Chairman of the Senate Committee on Appropriations, Adeola Olamilekan, openly questions the economic team’s confidence in delivering the proposed ₦58.7 trillion 2026 budget. Mediaplusng.com gathers that the senator asks whether the National Assembly should consider reducing the proposal if underlying assumptions appear weak.

He challenges the economic managers directly, asking whether maintaining the full budget size implies certainty in achieving revenue targets. Lawmakers argue that approving an inflated budget without clear execution capacity could worsen fiscal pressures and expand the deficit.

The debate also centers on the performance of the 2025 budget, with senators expressing frustration over delayed payments to contractors and limited capital project releases. Some committee members warn that stalled projects undermine economic growth, employment, and public confidence.

Responding to further inquiries, the Minister of State for Finance informs the committee that the Federal Government is prepared to begin settling outstanding payments linked to the 2025 fiscal year. She discloses that MDAs are directed to upload their cash plans immediately to facilitate the clearance of pending obligations.

According to her, payments for verified 2025 commitments are expected to commence immediately or, at the latest, by the following Monday. She reassures lawmakers that steps are being taken to improve coordination between revenue inflows and expenditure obligations.

The budget defence session reflects broader concerns about Nigeria’s fiscal sustainability, revenue mobilization strategies, and debt management trajectory. Analysts note that the scale of the proposed 2026 budget—estimated at ₦58.7 trillion—requires strong revenue performance, disciplined spending, and efficient execution mechanisms.

Following extensive exchanges and pointed questions, the Senate Committee on Appropriations moves into a closed-door session to deliberate further on the submissions and possible adjustments to the 2026 proposal.

The outcome of the deliberations could significantly shape the final structure of the 2026 national budget, particularly if lawmakers decide to revise projections downward in line with revenue realities.

As scrutiny of fiscal policy intensifies, the Senate signals its readiness to ensure that future budgets are built on transparency, accountability, and realistic economic assumptions to safeguard Nigeria’s financial stability.